1. Introduction

Tokyo Electron (TEL) is one of the world’s top suppliers of semiconductor manufacturing equipment, particularly in coater/developers, etch systems, and cleaning tools. While its core customers include global semiconductor giants such as TSMC, Samsung, and Intel, TEL’s performance is also closely tied to broader capex cycles in logic and memory industries. Between 2023 and 2025, TEL’s stock experienced a full cycle of bullish euphoria, sharp correction, and moderate recovery—closely mirroring the volatility in global semiconductor capital expenditures.

2. Stock Price Development: A Surge, a Slide, and a Stabilization

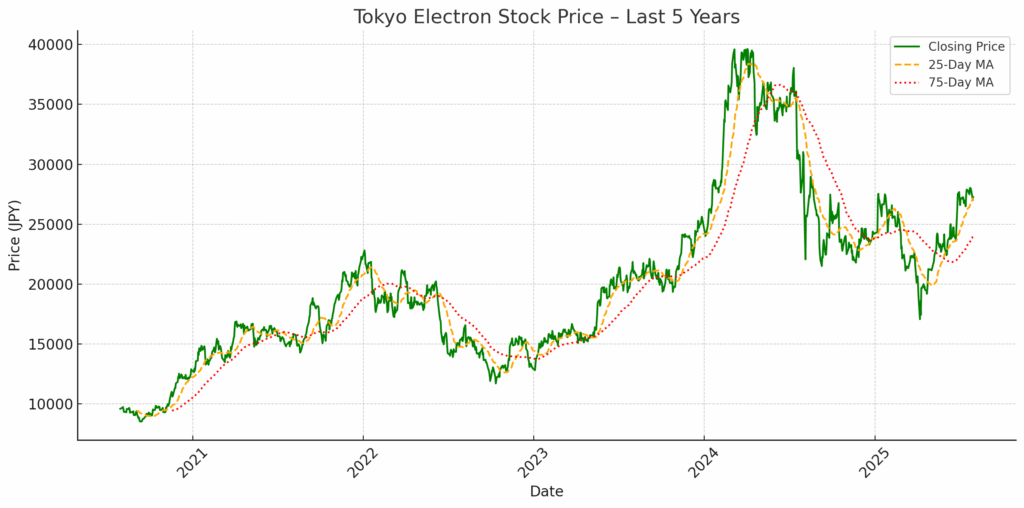

2.1 Bull Run Until April 2024

TEL’s stock price rose steadily from late 2023 through April 2024, reaching highs near ¥40,000, buoyed by investor optimism around AI-driven semiconductor demand.

Anticipated capital expenditures for 3nm and beyond, as well as emerging structures like GAA (Gate-All-Around) and 3D DRAM, spurred expectations for tool orders. Tokyo Electron gained particular favor due to its dominance in EUV-related coater/developer systems—critical for advanced lithography.

2.2 Correction: Late 2024 to Early 2025

From Q2 2024 onward, TEL shares dropped sharply, correcting by over 30% from their April peak of nearly ¥40,000 to a low near ¥27,550 in July 2024.

Key Drivers of the Correction:

A noticeable slowdown in new fab investments among global foundries.

Capex delays by customers in China and South Korea amid geopolitical uncertainty.

A broader tech stock pullback reflecting valuation concerns and rising interest rates.

Profit-taking behavior, especially following TEL’s rapid early-year gains.

In parallel, financial performance for FY2024 (ended March 2024) validated investor caution:

Revenue declined 17.1% YoY to ¥1.83 trillion.

Operating profit dropped 26.1% YoY to ¥456.2 billion.

PER temporarily peaked above 40x, triggering valuation-based sell-offs.

2.3 Stabilization and Recovery in 2025

After bottoming in mid-2024, TEL’s shares began to stabilize. The company posted record earnings for FY2025 (ended March 2025):

Revenue surged to ¥2.43 trillion (+32.8% YoY).

Operating profit increased to ¥697.3 billion (+52.8% YoY).

Net income jumped to ¥544.1 billion, up from ¥363.9 billion.

This recovery was driven by a resumption of tool demand for cutting-edge logic nodes, as well as a rebound in memory-related capex, particularly for DRAM and NAND applications.

3. Financial and Operational Analysis

Over the past five fiscal years, Tokyo Electron (TEL) has demonstrated strong earnings leverage, cyclical sensitivity, and resilience across multiple technology transitions. The following table summarizes key financial metrics from FY2021 to FY2025, grounded in company filings and year-end market prices.

3.1 Key Financial Metrics (FY2021–FY2025)

| Fiscal Year | Revenue (¥bn) | Operating Profit (¥bn) | Net Profit (¥bn) | ROE (%) | EPS (¥) | Stock Price (Mar-End) | PER (x) |

|---|---|---|---|---|---|---|---|

| FY2021 | 1,399.1 | 320.7 | 242.9 | 26.5 | 520.7 | ¥15,600 | 30.0x |

| FY2022 | 2,003.8 | 599.3 | 437.1 | 37.2 | 935.9 | ¥21,040 | 22.5x |

| FY2023 | 2,209.0 | 617.7 | 471.6 | 32.3 | 1,008.0 | ¥16,000 | 15.9x |

| FY2024 | 1,830.5 | 456.3 | 363.9 | 21.8 | 783.8 | ¥39,570 | 50.5x |

| FY2025 | 2,431.6 | 697.3 | 544.1 | 30.3 | 1,169.2 | ¥27,265 | 23.3x |

3.2 Observations

Growth and Contraction Cycles:

FY2021–FY2023 marked a phase of expansion supported by global semiconductor capex surges, particularly in logic and DRAM nodes. Revenue grew from ¥1.4 trillion to over ¥2.2 trillion.

FY2024 witnessed a cyclical downturn. Revenue fell 17.1% YoY and net profit dropped 22.8% YoY, reflecting delays in customer investments, especially in Asia.

FY2025 saw a strong rebound:

Revenue +32.8% YoY

Operating profit +52.8% YoY

Net income +49.4% YoY

ROE Trends:

ROE peaked at 37.2% in FY2022 and fell to 21.8% in FY2024 during the slowdown.

It recovered to 30.3% in FY2025, indicating improved capital efficiency alongside earnings normalization.

Valuation Dynamics:

PER hit 50.5x at the end of FY2024, indicating overvaluation risks despite weaker earnings.

The FY2025 correction brought PER back to 23.3x, in line with historical averages.

4. Strategic and Technological Positioning

Tokyo Electron (TEL) has laid out a clear and disciplined strategic roadmap, as evidenced by its official disclosures in the 2025 IR Day presentation, annual reports, and securities filings. The company’s strategy can be broken down into four primary domains: (1) Technology leadership, (2) Production and supply chain development, (3) Sustainability initiatives, and (4) Long-term business vision.

4.1 Technology Leadership and Product Focus

EUV Coater/Developer Systems

TEL holds over 80% global market share in EUV track systems (coater/developer), critical to 2nm and 3nm logic node production.

These tools accompany ASML’s EUV scanners and are indispensable in advanced lithography.

Etching Systems for GAA

TEL’s etch tools support the industry’s transition from FinFET to GAA transistor architectures.

High aspect ratio processing and anisotropic etching are key technical requirements TEL addresses.

Cleaning Tools and Packaging Equipment

TEL has competitive positions in cleaning tools, especially for advanced memory and 3D NAND.

The company is developing equipment for wafer-level packaging and 3D integration.

4.2 Global Production and Supply Chain Strategy

Japan (Miyagi, Kumamoto) remains TEL’s core manufacturing base, with government-supported capacity expansion.

Strategic localization is underway in:

Taiwan (supporting TSMC)

South Korea (Samsung memory/foundry)

U.S. (Intel, TSMC Arizona sites)

This global “multi-hub” strategy mitigates geopolitical and export control risks.

4.3 Sustainability and Environmental Strategy

Net-zero (Scope 1 & 2) target by 2050, 2030 interim goals aligned with 1.5°C target.

¥17.4 billion allocated to environmental-related investments in FY2025.

Life cycle assessments (LCA) and sustainability programs extended to suppliers.

4.4 Long-Term Vision and Future Roadmap

TEL aims to be the “Technology Enabler for a Data-Centric Society”.

R&D intensity: ¥148.7 billion in FY2025 (6.1% of revenue).

Focus areas: GAA process, atomic layer etch, packaging, and support for AI/HPC infrastructure.

5. Risks and Catalysts

Tokyo Electron (TEL) operates in a highly cyclical and technologically dynamic industry. The following analysis breaks down both external catalysts that could drive future growth, as well as inherent and emerging risks that investors should consider. Where applicable, we indicate whether the risk or opportunity is short-term, mid-term, or structural (long-term).

5.1 Catalysts

| Catalyst | Description | Timeline |

|---|---|---|

| AI and HPC Semiconductor Demand | The proliferation of generative AI, LLMs, and high-performance computing is driving demand for cutting-edge logic and HBM (high-bandwidth memory). TEL’s EUV track systems and advanced etch tools are critical enablers for sub-3nm nodes used in AI accelerators. | Short to Mid-Term |

| Gate-All-Around (GAA) Transition | Major foundries such as TSMC, Samsung, and Intel are shifting to GAA transistor architecture at the 2nm node and beyond. TEL is heavily investing in etch and cleaning tools optimized for this new structure. | Mid-Term |

| 3D NAND Scaling | NAND flash memory manufacturers are targeting 300+ layers, which require precision cleaning and etching at extreme aspect ratios—areas where TEL holds competitive advantage. | Mid-Term |

| Advanced Packaging Growth | The transition to chiplet-based architectures, 2.5D and 3D IC packaging is accelerating. TEL is developing coating and cleaning equipment for these backend processes. | Mid-Term |

| Geopolitical Capex Realignment | Global reshoring initiatives such as the U.S. CHIPS Act, Japan’s HINOME subsidy program, and EU IPCEI funding are catalyzing new fab construction in TEL’s core markets, boosting demand for domestic suppliers. | Structural |

| Sustainability-Driven Equipment Investment | As semiconductor companies set net-zero targets, demand is rising for tools with lower energy consumption, water usage, and carbon footprint. TEL is aligning its roadmap with these ESG priorities. | Structural |

5.2 Risks

| Risk | Description | Timeline | Mitigation / Comment |

|---|---|---|---|

| Semiconductor Capex Cyclicality | TEL’s revenue is highly sensitive to investment cycles in logic and memory. In downturns, such as in 2023, customers may defer or cancel tool purchases. | Short-Term | TEL has a diversified client base and increasing service revenue, which adds recurring stability. |

| China-Related Export Controls | U.S. export restrictions have limited TEL’s ability to supply certain advanced tools to Chinese fabs, particularly in logic and EUV-related areas. | Short to Mid-Term | TEL has expanded local service bases and adjusted supply chains to mitigate geopolitical disruptions. |

| Technology Substitution Risk | Innovations such as dry resist lithography, hybrid bonding, and alternative patterning approaches could reduce demand for TEL’s conventional coater/developer or etch products. | Mid-Term | TEL spends over 6% of revenue on R&D and collaborates with leading chipmakers to stay ahead of process shifts. |

| Supply Chain Disruptions | TEL depends on complex components and precision parts. Natural disasters (e.g., Kumamoto earthquakes) or global shortages could impair production and delay deliveries. | Mid-Term | The company has robust business continuity plans, diversified sourcing, and multiple production hubs. |

| ESG Compliance Pressure | Rising expectations around emissions, water use, and product sustainability may impose regulatory or capital burdens if unmet. | Structural | TEL has committed to Scope 1 and 2 net-zero by 2050 and applies ESG criteria to suppliers and internal design. |

| Valuation Sensitivity | TEL’s shares have historically commanded premium valuations (e.g., over 40x PER in FY2024), making them vulnerable to corrections amid broader market pullbacks. | Short-Term | PER has normalized to ~17x after strong FY2025 earnings, improving valuation support. |

5.3 Summary Table

| Area | Upside Catalyst | Risk Factor |

|---|---|---|

| Technology Trends | AI, HPC, GAA, 3D NAND | Disruption by alternative architectures |

| Geographic Strategy | Reshoring in US/EU/Japan | Exposure to China-related regulation |

| Product Portfolio | Advanced packaging tools | Yield risks with new materials |

| Supply Chain | Global footprint and BCP | Component constraints, disasters |

| Financials | High ROE and cash flow | Cyclical earnings, high fixed cost base |

| Sustainability | ESG-aligned R&D and tools | Regulatory tightening, cost burden |

6. Conclusion

Tokyo Electron (TEL) has demonstrated its resilience and strategic importance in the global semiconductor ecosystem. Despite the sharp correction following its 2024 stock price peak—driven by geopolitical uncertainties, capex delays, and valuation concerns—TEL has proven its ability to rebound swiftly, underscored by its record FY2025 earnings.

The company’s core strengths lie in its:

Dominant position in EUV track systems, a technology essential for sub-3nm logic production.

Strategic alignment with industry megatrends, including AI acceleration, GAA transistor adoption, and 3D NAND scaling.

Balanced global production network, which hedges against supply chain disruptions and regional export risks.

Commitment to sustainability, evidenced by concrete Scope 1 & 2 targets and ESG-aligned capital allocation.

Robust financial structure, with strong ROE and reinvestment in R&D exceeding 6% of revenue.

While the semiconductor equipment market remains inherently cyclical, TEL’s diversification across customers and technology nodes provides a buffer against single-market downturns. Its continued investment in next-generation etch, clean, and packaging tools positions it well for long-term structural growth—particularly as packaging becomes increasingly critical in the AI and HPC era.

That said, investors must be mindful of the elevated fixed cost structure, potential technology substitution (e.g., dry resist, hybrid bonding), and regulatory risks surrounding China-related export controls. Furthermore, TEL’s valuation, although normalized post-correction, may remain sensitive to shifts in global risk appetite and interest rate trends.

In sum, Tokyo Electron stands out as a high-quality, innovation-driven company with both operational leverage and strategic tailwinds. It remains a compelling long-term investment candidate in the semiconductor value chain, provided that investors are prepared for short-term volatility and maintain a forward-looking view rooted in technological and geopolitical developments.

At Wasabi Info, we publish concise equity reports and market insights through our blog—

but our core value lies in providing bespoke, on-demand research for international clients.

Whether you are a private investor or a corporation, we deliver confidential, tailored intelligence designed to support strategic decisions.

Our research services include:

• Equities: In-depth analysis of Japan-listed companies not featured in the blog

• Competitor Analysis: Detailed mapping of industry rivals and market dynamics

• Market Entry Intelligence: Insights into local barriers, regulations, and competitor positioning

• Real Estate & Assets: Localized assessments for factory, hotel, or retail expansion

• Field Intelligence: On-the-ground surveys and discreet market checks unavailable through public sources

Reports are available in English, Chinese, and Japanese.

For inquiries, please contact: admin@wasabi-info.com

© Wasabi Info | Privacy Policy

Disclaimer

This report is intended for informational purposes only and does not constitute investment advice. The analysis contains forward-looking statements and interpretations based on publicly available information as of the date of writing. Readers should conduct their own research and consult with a licensed financial advisor before making any investment decisions.

Wasabi-info.com shall not be held liable for any loss or damage arising from the use of this report or reliance on its contents.