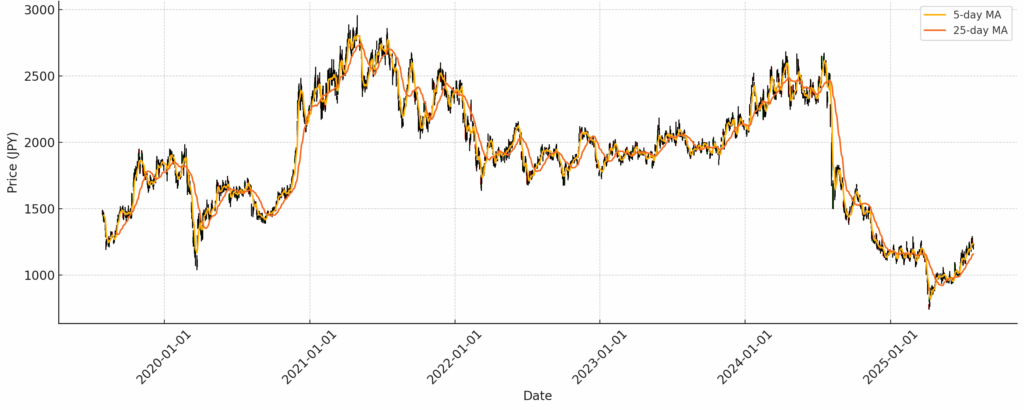

Equity Analysis: SUMCO Corporation (TSE: 3436) – Stock Price Trend and Business Update

Stock Price Development and Context

SUMCO Corporation’s share price has declined substantially since the summer of 2024, falling from a peak of approximately ¥2,500 to ¥1,234 as of July 25, 2025 — a drop of over 50%.

While the precise reasons for this decline are not definitively known, the following factors may have contributed:

Earnings Deterioration: The company is forecasting an operating profit near zero and a net loss of ¥10 billion for FY2025, despite stable revenue levels around ¥400 billion. This marks a significant downturn in profitability.

Heavy Fixed Cost Burden: Ongoing capital investments have led to a notable increase in depreciation expenses. Due to low facility utilization, these fixed costs are not being offset by sufficient operating leverage.

Margin Pressure: Although demand for 300mm wafers remains relatively resilient, the recovery in smaller wafer sizes has been weak. Combined with rising raw material, energy, and labor costs, this may be compressing gross margins.

Market Sentiment: Investor confidence may have weakened due to the above profitability concerns and the absence of clear near-term earnings recovery signals.

Current Valuation and Market Sentiment

At ¥1,234 per share, SUMCO’s valuation reflects a mix of near-term pessimism and medium-term hope:

Short-Term Concerns:

Weak earnings outlook.

Negative net profit forecast for FY2025.

Market skepticism on wafer ASP (Average Selling Price) recovery.

Long-Term Upside Factors:

Structural demand from AI, EVs, and data infrastructure.

Strategic investment positioning SUMCO for volume leverage post-2026.

Industry consolidation and potential for pricing power recovery.

Investors should assess whether the current stock price reflects temporary headwinds or deeper structural issues. The company’s long-term positioning may appeal to investors with a longer investment horizon.

At Wasabi Info, we publish concise equity reports and market insights through our blog—

but our core value lies in providing bespoke, on-demand research for international clients.

Whether you are a private investor or a corporation, we deliver confidential, tailored intelligence designed to support strategic decisions.

Our research services include:

• Equities: In-depth analysis of Japan-listed companies not featured in the blog

• Competitor Analysis: Detailed mapping of industry rivals and market dynamics

• Market Entry Intelligence: Insights into local barriers, regulations, and competitor positioning

• Real Estate & Assets: Localized assessments for factory, hotel, or retail expansion

• Field Intelligence: On-the-ground surveys and discreet market checks unavailable through public sources

Reports are available in English, Chinese, and Japanese.

For inquiries, please contact: admin@wasabi-info.com

© Wasabi Info | Privacy Policy

Disclaimer

This report is provided for informational purposes only and does not constitute investment, legal, or tax advice.

The analysis may include forward-looking statements and interpretations based on publicly available information as of the date of writing.

Readers are solely responsible for their own investment decisions and should seek advice from a licensed financial advisor or other qualified professional.

Wasabi-Info.com makes no representation or warranty, express or implied, regarding the accuracy, completeness, or reliability of the information contained herein, and shall not be held liable for any loss or damage arising from the use of this report.