Toyo Tanso (TSE: 5310) Stock Analysis: Positioned for Structural Growth in Advanced Carbon Materials

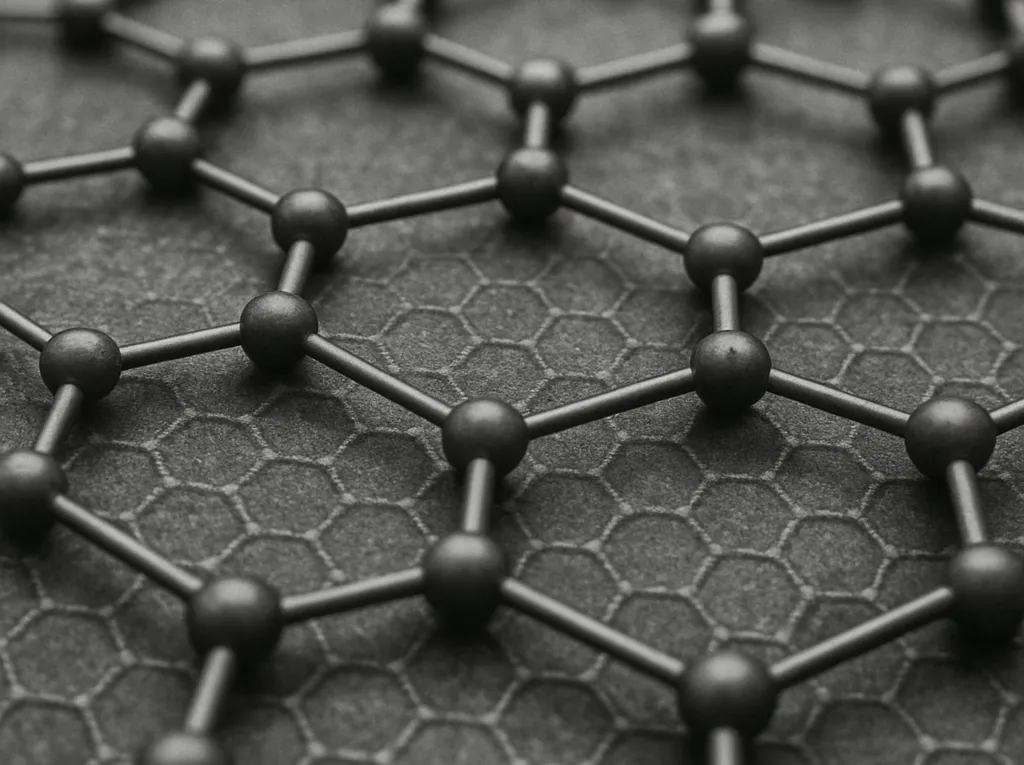

TOYO TANSO CO., LTD. (TSE: 5310): Stock Analysis September 23, 2025 1. IntroductionToyo Tanso Co., Ltd. is a global pioneer in the development and mass production of isotropic graphite and…