1. Company Overview

Hokuryo Co., Ltd. is one of Japan’s leading egg producers with a vertically integrated business model. The company manages the entire supply chain—from chick rearing to egg production, packaging, and direct distribution—without relying on wholesalers. It operates six branches in Hokkaido and two in the Tohoku region, supplying major supermarket chains nationwide.

Key highlights:

Farms in Hokkaido (Sapporo, Tokachi, Noboribetsu, Kitami, Chitose, Hayakita) and Tohoku (Morioka, Hamanasu, Yoshimeki).

In-house chick rearing in dedicated farms.

Brand concept: “Eggs from Garden Farms”—emphasizing environmental harmony and hygiene.

2. Financial Performance (FY2023–FY2025)

| Fiscal Year End | Revenue (bn JPY) | Net Profit (bn JPY) | EPS (JPY) | DPS (JPY) | ROE (%) | PER (x) |

|---|---|---|---|---|---|---|

| March 2023 | 17.8 | 0.75 | 88.13 | 20.0 | 7.1 | 9.2 |

| March 2024 | 18.9 | 1.66 | 195.81 | 40.0 | 14.4 | 5.4 |

| March 2025 | 19.4 | 2.18 | 257.93 | 70.0 | 16.5 | 5.4 |

Profitability has significantly improved with an EPS CAGR of 67.7% (FY2023–FY2025).

Steady dividend growth with payout ratio remaining moderate (27.1% in FY2025).

ROE expansion signals strong capital efficiency and shareholder returns.

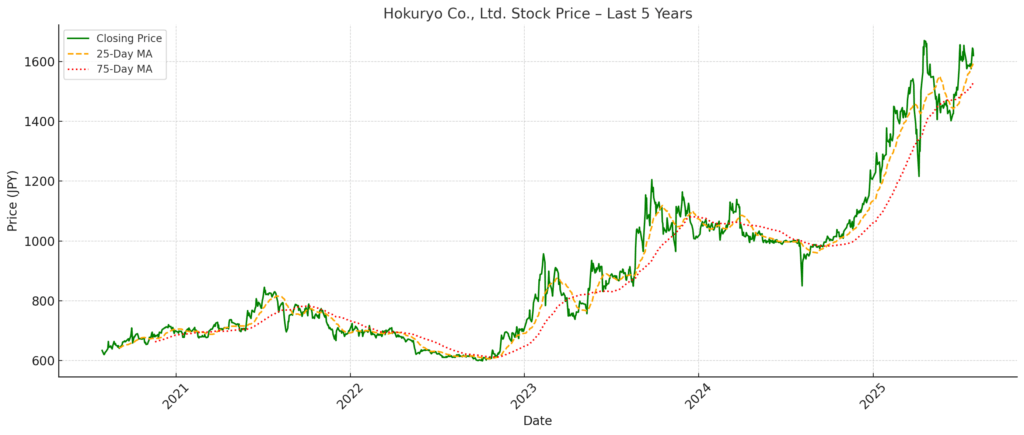

3. Stock Price Development and Drivers

Since early 2023, Hokuryo’s stock has risen sharply—from around ¥700 to over ¥1,500 by mid-2025, marking a more than 100% increase in just over two years.

Key factors behind the rally:

Surging profits supported by operational efficiencies and higher egg prices.

Strong demand for safe, traceable food in Japan’s aging society.

Strategic investment in animal welfare (e.g., cage-free “Aviary” farming) aligned with global ESG trends.

Direct-to-retail model offers pricing power and margin stability.

Despite macro headwinds (feed cost inflation, avian flu risks), Hokuryo has demonstrated robust risk management and continues to outperform peers in both financials and branding.

4. Animal Welfare & ESG Positioning

As a responsible livestock producer, Hokuryo is committed to aligning with the global standards of Animal Welfare (AW). The company actively promotes conditions that ensure the health, safety, and natural behavior of its laying hens based on the internationally recognized “Five Freedoms” framework:

Freedom from hunger and thirst

→ Providing hygienic, nutritionally adequate feed that meets the birds’ dietary needs.

Freedom from discomfort

→ Maintaining appropriate housing with sufficient space, temperature, and humidity for animal comfort.

Freedom from pain, injury, or disease

→ Prohibiting harmful physical alterations such as beak trimming, and ensuring veterinary care for any illness or injury.

Freedom from fear and distress

→ Building a stress-free environment through positive human-animal interactions and calm, controlled handling.

Freedom to express normal behavior

→ Enabling natural behaviors such as perching, nesting, and dust bathing through cage-free Aviary systems installed in farms like Yoshimeki and Sapporo.

These initiatives are supported by advanced environmental control systems, full traceability (with printed expiry and lot numbers on each egg), and strict hygiene standards, including FSSC22000 certification at all packing facilities.

Hokuryo continues to expand its AW efforts progressively, balancing ethical farming practices with economic feasibility to meet consumer expectations in a sustainable way.

5. Investment Outlook

Valuation remains attractive: PER at ~5.4x and PBR under 1.0x.

Dividend yield >4% with continuous increases.

Low volatility and consistent operating cash flow make Hokuryo a potential core holding for long-term, yield-focused investors.

While liquidity may be limited due to its small-cap nature, Hokuryo represents a compelling opportunity in Japan’s food safety and ESG-driven investment themes.

6. Conclusion

Hokuryo combines strong financial fundamentals, consistent shareholder returns, and a forward-looking commitment to animal welfare and food safety. With its vertically integrated model and ESG-aligned farming practices, the company is well-positioned to maintain profitability and brand value in Japan’s food supply chain.

Its compelling valuation—low PER, high ROE, and rising dividends—makes it an attractive candidate for long-term investors seeking stability and ethical exposure in the consumer staples sector.

As consumer awareness and regulatory attention toward animal welfare and traceability grow, Hokuryo’s early investments in these areas may serve as a catalyst for sustained stock price appreciation.

At Wasabi Info, we publish concise equity reports and market insights through our blog, and also provide custom, tailor-made research to support strategic decision-making for both private investors and corporations.

Our research services include:

• Equities: In-depth analysis of Japan-listed companies not featured in the blog

• Competitor Analysis: Detailed mapping of industry rivals and market dynamics

• Market Entry Intelligence: Insights into local barriers, regulations, and competitor positioning

• Real Estate & Assets: Localized assessments for factory, hotel, or retail expansion

• Field Intelligence: On-the-ground surveys and discreet market checks unavailable through public sources

Reports are available in English, Chinese, and Japanese.

For inquiries, please contact: admin@wasabi-info.com

© Wasabi Info | Privacy Policy

Disclaimer

This report is provided for informational purposes only and does not constitute investment, legal, or tax advice.

The analysis may include forward-looking statements and interpretations based on publicly available information as of the date of writing.

Readers are solely responsible for their own investment decisions and should seek advice from a licensed financial advisor or other qualified professional.

Wasabi-Info.com makes no representation or warranty, express or implied, regarding the accuracy, completeness, or reliability of the information contained herein, and shall not be held liable for any loss or damage arising from the use of this report.