Kyokuyo Co., Ltd. (TSE: 1301): Stock Analysis

August 4, 2025

1. Introduction

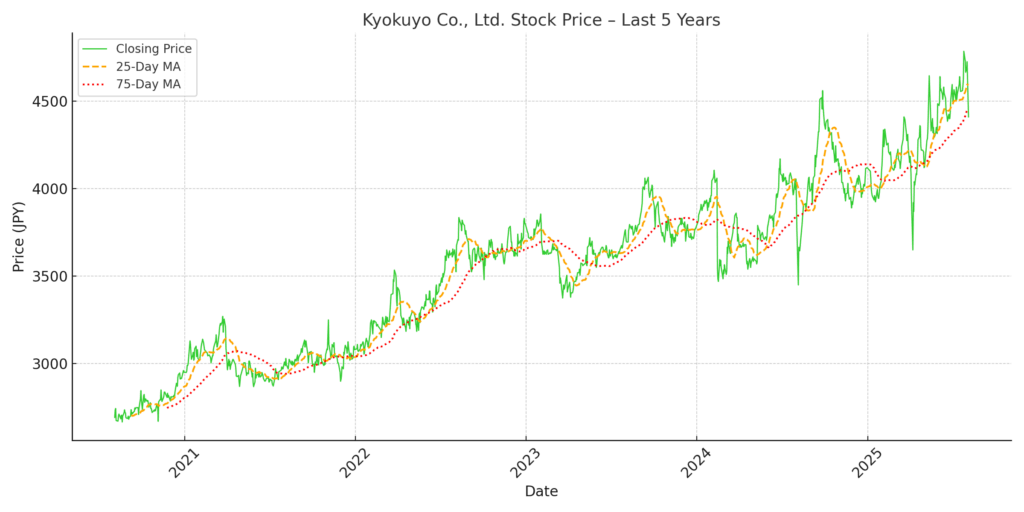

Kyokuyo Co., Ltd., a long-established Japanese seafood and food processing company, has emerged as one of the strongest performers in Japan’s mid-cap consumer sector. The stock price has nearly doubled since mid-2023, rising from around ¥2,400 to over ¥4,700 in July 2025.

While earnings growth and governance improvements have played a role, revenue expansion is the primary engine behind this rally — and deserves a closer look.

2. What’s Driving the Revenue Surge?

Kyokuyo’s revenue reached a record ¥302.6 billion in FY2025, marking a +15.6% year-on-year increase. This is not a result of one-off effects, but rather the product of multi-layered, structural growth initiatives:

(1) Strong Product Demand in Key Categories

| Segment | YoY Revenue Growth | Description |

|---|---|---|

| Marine Products | +12.1% | Robust demand for sashimi-grade tuna, bonito, and sushi ingredients. Farm-raised bluefin tuna segment expanded. |

| Fresh Foods | +9.1% | Strong sales of sashimi salmon and chilled seafood, especially to major Japanese retailers. |

| Processed Foods | +17.1% | Booming sales of frozen ready-to-eat meals (e.g., “Dandori Jozu” series). Growth in both B2B and B2C channels. |

| Logistics Services | +25.3% | Cold storage operations benefiting from high occupancy and new warehouse capacity. |

(2) Expansion of High-Margin Product Lines

Rather than pursuing volume for volume’s sake, Kyokuyo shifted toward high-margin value-added products:

Sushi-ready tuna & salmon: stable demand in both Japan and abroad

Cooked seafood & microwave-ready meals: growing health-conscious and convenience-driven markets

OEM partnerships with major food service chains and supermarkets

These items carry higher unit prices, improving both revenue and profitability simultaneously.

(3) New Facilities & Global Supply Chain Investments

Investments made in prior years started yielding returns in FY2025:

Tottori plant (Japan): Expanded processed food production capacity

Vietnam (Kyokuyo Vina Foods): Cost-efficient seafood processing for Japan & ASEAN

USA (Ocean’s Kitchen): Local production-to-distribution model for North American market

Netherlands (Kyokuyo Europe): Strategic hub to penetrate EU markets

These investments support the company’s “Produce globally, sell globally” strategy.

(4) Shift in Customer Channels and Market Share Gains

Growth in mass retailers, supermarkets, and convenience stores

Increased demand from institutional foodservice clients

Gains in domestic and international private-label supply channels

This has led to greater sales stability and reduced dependence on wholesale price fluctuations.

(5) Pricing Power and Currency Tailwinds

Kyokuyo leveraged its brand strength and product quality to pass on price increases during inflationary periods.

Yen depreciation in FY2024–25 enhanced export competitiveness and boosted overseas earnings.

3. Stock Price Performance and Current Valuation

As of August 4, 2025, Kyokuyo shares are priced at ¥4,410, slightly below the July peak of ¥4,725.

EPS (FY2025): ¥567.48

PER (Trailing): ~7.8x

Dividend: ¥130/share → Yield ~2.9%

Despite a doubling in stock price, Kyokuyo still trades below the average P/E for Japan’s food sector (typically 12–15x), suggesting room for further rerating.

4. Long-Term Strategic Positioning: “Gear Up Kyokuyo 2027” in Action

In 2024, Kyokuyo unveiled its new mid-term business plan titled “Gear Up Kyokuyo 2027.” This plan represents a significant strategic evolution, aiming to transform Kyokuyo from a primarily domestic seafood supplier into a global, value-added, ESG-driven food company with diversified earnings streams.

4.1 Vision and Pillars of the 2027 Plan

Kyokuyo’s long-term strategy is built around five foundational pillars:

| Pillar | Strategic Focus |

|---|---|

| 1. Business Expansion | Grow revenue to ¥400 billion by FY2027 |

| 2. Overseas Business | Raise overseas sales ratio to 15%+ |

| 3. Profitability & Efficiency | Improve operating margin and ROIC |

| 4. Capital Allocation | Return cash through DOE-based dividends |

| 5. Sustainability & ESG | Accelerate sustainable sourcing, carbon reduction, and governance reform |

4.2 Financial Targets and Progress

| Metric | FY2025 (Actual) | FY2027 (Target) | Comments |

|---|---|---|---|

| Revenue | ¥302.6 billion | ¥400 billion | Requires ~15% CAGR over two years |

| Operating Profit | ~¥11 billion | ¥13.5 billion | Margin expansion via high-value products |

| Overseas Revenue Ratio | ~10% (estimated) | 15%+ | Accelerated by U.S., Europe, and ASEAN |

| ROIC | Improving | >6% | Capital discipline and inventory turnover improvements |

| Dividend Policy | ¥130/share (DOE ~3%) | Maintain DOE framework | Consistent with capital return commitment |

The strategy is not merely aspirational — Kyokuyo is already tracking ahead of plan in several areas, particularly overseas expansion and logistics profitability.

4.3 Overseas Expansion Strategy

Kyokuyo is building a multi-hub global footprint for sourcing, production, and sales:

| Region | Activity |

|---|---|

| Vietnam | Seafood processing at Kyokuyo Vina Foods (low-cost, stable supply) |

| United States | Ocean’s Kitchen USA serves local B2B clients (e.g., sushi chains) |

| Netherlands | Kyokuyo Europe acts as EU distribution base |

| China/Korea | Export markets for value-added Japanese products |

| ASEAN | Targeting new markets for both marine and frozen foods |

This approach mitigates FX and geopolitical risk while positioning Kyokuyo as a global player in seafood innovation.

4.4 Domestic Market Strategy

In Japan, the company is defending and strengthening its home turf through:

High-margin branded products (e.g., “Dandori Jozu” frozen meal series)

Expansion of direct sales to supermarkets and food service

Upgrades in cold-chain logistics infrastructure (25% YoY growth in warehouse utilization)

New product development in health-conscious, convenience, and sustainability segments

Rather than chasing volume, the focus is on value-added transformation of traditional segments.

4.5 Supply Chain & Infrastructure Investment

Kyokuyo is investing in:

Digitalization of inventory and procurement systems

Automation in processing facilities (e.g., Tottori plant)

Cold chain upgrades to meet growing demand for temperature-controlled distribution

Sustainability-linked upgrades (e.g., reducing water and energy use)

These investments are already showing returns, especially in the logistics segment — now a growing source of stable, recurring income.

4.6 ESG & Sustainability Integration

Kyokuyo integrates ESG goals into its long-term positioning:

| ESG Factor | Actions Taken |

|---|---|

| Environment | 78% of seafood now from certified sustainable sources; goal: 100% by 2030 |

| Social | Ethical sourcing, worker safety, and food safety controls across international facilities |

| Governance | Board structure includes >50% independent directors; executive officer system adopted; DOE-based dividends |

These initiatives enhance long-term resilience and align with the expectations of global institutional investors.

4.7 Competitive Positioning in the Global Seafood Industry

| Factor | Kyokuyo’s Strength |

|---|---|

| Product Differentiation | Branded sushi-ready tuna, salmon, frozen meals |

| Vertical Integration | In-house processing, cold-chain logistics, retail relationships |

| Global Reach | Active presence in Japan, U.S., EU, Vietnam, and more |

| ESG Credentials | Strong sustainability sourcing record (vs. peers in Asia) |

Kyokuyo’s “Gear Up 2027” is not just a roadmap — it’s a well-executed strategic transformation already delivering results. The company has carved out a defensible position in an industry prone to commoditization and price volatility by:

・Focusing on value over volume

・Expanding globally with localized operations

・Investing in logistics and automation

・Embracing capital discipline and ESG compliance

For long-term investors, this positions Kyokuyo as a rare breed: a defensive, dividend-paying consumer staple with secular growth drivers.

5. Conclusion

Kyokuyo Co., Ltd. is no longer just a domestic seafood wholesaler — it is transforming into a global, value-added, and ESG-conscious food company with diversified earnings engines and long-term structural tailwinds.

The stock’s remarkable performance over the past two years is not driven by speculation, but by solid fundamentals:

Consistent revenue and earnings growth, driven by high-margin frozen foods, fresh seafood, and logistics

Global expansion through Vietnam, the U.S., and Europe — boosting both resilience and growth potential

Strategic capital investments in logistics, digitalization, and automation that are already generating returns

Shareholder-friendly policies, including a dividend based on DOE (3%) and improving ROE/ROIC

Strong ESG positioning, with 78% of seafood now sustainably sourced and a roadmap to 100% by 2030

Kyokuyo’s mid-term plan, Gear Up Kyokuyo 2027, sets credible and measurable targets — and the company is already ahead of schedule in several key areas.

At a valuation of ~7.8x PER and a ~2.9% dividend yield, the stock remains attractively priced relative to its growth outlook and strategic clarity.

At Wasabi Info, we publish concise equity reports and market insights through our blog—

but our core value lies in providing bespoke, on-demand research for international clients.

Whether you are a private investor or a corporation, we deliver confidential, tailored intelligence designed to support strategic decisions.

Our research services include:

• Equities: In-depth analysis of Japan-listed companies not featured in the blog

• Competitor Analysis: Detailed mapping of industry rivals and market dynamics

• Market Entry Intelligence: Insights into local barriers, regulations, and competitor positioning

• Real Estate & Assets: Localized assessments for factory, hotel, or retail expansion

• Field Intelligence: On-the-ground surveys and discreet market checks unavailable through public sources

Reports are available in English, Chinese, and Japanese.

For inquiries, please contact: admin@wasabi-info.com

© Wasabi Info | Privacy Policy

Disclaimer

This report is intended for informational purposes only and does not constitute investment advice. The analysis contains forward-looking statements and interpretations based on publicly available information as of the date of writing. Readers should conduct their own research and consult with a licensed financial advisor before making any investment decisions.

Wasabi-Info.com shall not be held liable for any loss or damage arising from the use of this report or reliance on its contents.