Mitsui & Co., Ltd. (TSE: 8031): Stock Analysis

September 1, 2025

1. Introduction

Mitsui & Co., Ltd. is a globally integrated trading and investment company headquartered in Tokyo, Japan. With a legacy dating back to the 19th century and formal incorporation in 1947, Mitsui has become a core pillar of the Japanese economy and a strategic player in global commerce. As a member of the TOPIX Core 30 and Nikkei 225 indices, the company boasts a well-diversified business portfolio encompassing upstream resources, midstream infrastructure, downstream consumer services, and cutting-edge digital ventures.

Mitsui operates across more than 60 countries and regions, maintaining equity stakes and operational control in over 500 group companies. The company’s strength lies in its ability to leverage deep domain expertise, financial discipline, and long-standing global networks to create sustainable value across economic cycles.

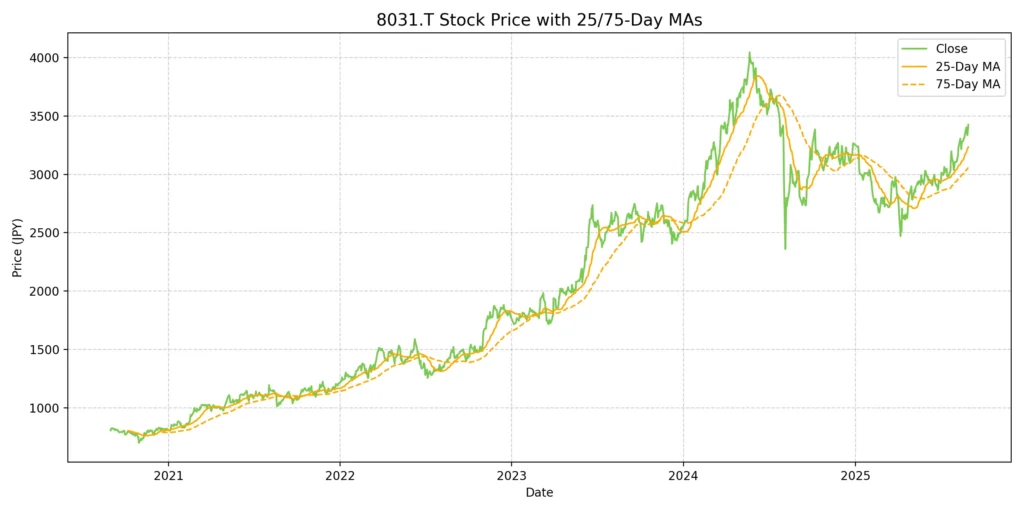

2. Stock Price Performance

Share Price: ¥3,426 (as of August 31, 2025)

52-week Range: ¥2,365 – ¥3,456

Market Capitalization: ~¥9.6–9.7 trillion

5-Year Total Shareholder Return: +252.7%

Dividend Yield (FY2025): ~2.9%

The stock has delivered exceptional long-term returns, driven by commodity booms (notably LNG and iron ore), disciplined shareholder returns, and strong earnings growth in FY2021–2023. FY2025 marked a period of earnings normalization following record profits, leading to range-bound price action. Nonetheless, valuation remains attractive relative to historical multiples and global peers.

Investor sentiment remains favorable, underpinned by Mitsui’s proven resilience, clarity of strategy, and commitment to capital returns. The company continues to be perceived as one of the most dependable and internationally diversified among Japanese conglomerates.

3. Financial and Operational Performance

| Fiscal Year Ended | Revenue (JPY Bn) | Operating Profit (JPY Bn) | Net Profit (JPY Bn) | EPS (¥) | Dividend (¥) |

|---|---|---|---|---|---|

| Mar 2023 | 14,306.4 | 751.7 | 1,130.6 | 360.9 | 70 |

| Mar 2024 | 13,324.9 | 703.9 | 1,063.7 | 352.8 | 85 |

| Mar 2025 | 14,662.6 | 570.9 | 900.3 | 306.7 | 100 |

Revenue: FY2025 saw a strong rebound in top-line performance (+10.1% YoY), driven primarily by increased volumes in energy trading (notably LNG) and robust consumer demand in the Lifestyle segment.

Operating Profit: Fell by 18.9% YoY due to commodity margin compression and higher depreciation charges associated with capital expenditures in digital infrastructure and LNG assets.

Net Profit: Declined for the second consecutive year, reflecting post-peak normalization in resource markets and FX impacts.

EPS and Shareholder Returns: Despite lower earnings, EPS remained above ¥300. Mitsui increased its dividend to ¥100 per share, reflecting confidence in cash generation and commitment to stable payouts.

Cash flow remains robust, with operating cash flow consistently exceeding ¥1 trillion. Mitsui continues to prioritize capital discipline, balancing growth investment with enhanced shareholder returns.

4. Business Segments and Strategy

Segment Overview

| Segment | Description | Strategic Themes |

|---|---|---|

| Metals & Minerals | Iron ore, copper, coking coal, lithium, rare earths | Secure supply of critical minerals, EV value chains |

| Energy | Oil, LNG, hydrogen, ammonia | Energy security, decarbonization, LNG liquefaction & trade |

| Machinery & Infrastructure | Mobility, transportation, power, water | Smart cities, green energy infrastructure, PPPs |

| Chemicals | Petrochemicals, fertilizers, specialty chemicals | Circular economy, carbon-efficient production |

| Iron & Steel Products | Flat/long steel, pipes, automotive materials | Demand optimization, digital supply chain visibility |

| Lifestyle | Food, retail, healthcare, wellness | IHH Healthcare (Asia’s leading private hospital group), premium food value chain development |

| Innovation & Corp. Dev. | Digital, AI, VC, fintech, asset management | Industrial DX, venture incubation, data-driven services |

Medium-Term Management Plan 2026 – “Creating Sustainable Futures”

The current strategy focuses on three pillars:

Competitiveness in Transition

Leadership in LNG value chains and next-gen fuels (hydrogen, ammonia)

Industrial decarbonization via carbon capture and storage (CCS), biofuels

Value-Added Platforms

Healthcare (IHH, diagnostics, telemedicine)

Retail and wellness (cold-chain, food safety tech)

Digital platforms (AI logistics, asset-light models)

Capital Discipline & Governance

Targeting ROE >10%, core FCF ~¥1 trillion/year

Payout ratio >35%, flexible share buybacks

Strengthened ESG monitoring, human capital development, global mobility

5. Investment Outlook and Catalysts

Structural Strengths

Diversified Cash Flows

Mitsui generates earnings across multiple sectors—cyclical (resources), stable (infrastructure), and growth-oriented (healthcare, digital). This diversified income base reduces dependence on any single market cycle and enhances long-term resilience.Global Presence and Operational Reach

With activities in over 60 countries and partnerships across Asia, the Americas, and the Middle East, Mitsui can tap into growth markets and mitigate regional risks through geographic diversification.Capital Efficiency

A return on equity consistently above 12%, core free cash flow over ¥1 trillion annually, and disciplined capital deployment place Mitsui among the most efficient Japanese conglomerates.ESG and Energy Transition Leadership

Active investment in ammonia, hydrogen, CCS (carbon capture & storage), and sustainable fuels positions Mitsui to benefit from global decarbonization trends. Its integrated LNG value chain supports both energy security and transition goals.Digital and Healthcare Platforms

Through its Innovation and Lifestyle segments, Mitsui is monetizing future-ready domains such as AI logistics, telemedicine, and premium food infrastructure—sectors less correlated with commodity volatility.

Near-Term Catalysts

IHH Healthcare Monetization

A potential IPO, restructuring, or asset monetization of Mitsui’s 32%-owned IHH Healthcare could unlock shareholder value and showcase Mitsui’s healthcare credentials.Green Energy Expansion

Scaling up infrastructure for hydrogen, ammonia bunkering, and renewable energy storage may open new high-ROE business lines aligned with global ESG mandates.Digital Logistics Rollout

Expansion of AI-powered logistics solutions in Asia and Japan could improve margins in non-resource segments and strengthen Mitsui’s innovation narrative.LNG Price Cycles and Contract Renewals

Mitsui’s exposure to long-term LNG contracts provides both revenue stability and upside optionality as global demand tightens—particularly in Asia and Europe.Capital Return Upside

With over ¥300B in unused buyback authorization and strong FCF, Mitsui has capacity to boost shareholder returns depending on market conditions.Currency Tailwinds

A continued weak yen environment enhances profit translation from overseas earnings, supporting consolidated performance in JPY terms.

6. Risk Factors

Market and Macroeconomic Risks

Commodities

Prolonged declines in the prices of LNG, iron ore, copper, or coking coal could materially affect Mitsui’s earnings, given its significant exposure to upstream resource projects. Key variables include oversupply, demand slowdown in China, and OPEC+ production policy shifts.Foreign Exchange Volatility

While a weaker yen supports profit repatriation, rapid yen appreciation could erode earnings from overseas operations. Mitsui’s global footprint makes it particularly sensitive to USD/JPY and emerging market currency fluctuations.Interest Rate and Inflation Pressure

Rising interest rates globally could increase the cost of capital, especially for large infrastructure and energy projects. Inflation in key markets may also compress margins in consumer, logistics, and infrastructure businesses.

Geopolitical and Regulatory Risks

Country Risk

Mitsui operates in geopolitically sensitive regions including Russia, the Middle East, and Sub-Saharan Africa. Exposure to resource nationalism, economic sanctions, and political instability could impair asset values or disrupt operations.Environmental and Regulatory Uncertainty

Policy shifts in carbon taxation, safety standards for ammonia and hydrogen, and energy transition targets may delay the commercialization of clean fuel investments. Approval bottlenecks for hydrogen or CCS projects could affect ROI.Trade and Sanctions Risk

As a global trading house, Mitsui is vulnerable to disruptions from trade tensions, particularly U.S.–China relations, EU carbon border adjustments, or regional protectionism, which could reconfigure supply chains.

Strategic and Execution Risks

Execution Complexity

Mitsui’s vast portfolio—over 500 subsidiaries across diverse sectors and regions—creates managerial complexity. Misalignment among JV partners, integration issues, or governance lapses could affect performance.Transition Risk

Shifting from legacy profit centers (e.g., energy & metals) to next-generation areas (e.g., digital logistics, healthcare, green energy) carries risk of underperformance, technology obsolescence, or talent acquisition challenges.Concentration Risk in LNG

While LNG is a growth pillar, over-reliance on a single transition fuel poses concentration risk. Project delays, liquefaction issues, or unfavorable contract terms could impair returns.Reputational and ESG Risk

Failure to meet stated ESG targets, participation in controversial projects, or weak climate disclosures may lead to reputational damage, loss of stakeholder trust, and exclusion from ESG indices or institutional investor portfolios.

7. Peer Comparison: Strategic Positioning in the Trading House Landscape

Japan’s sogo-shosha sector is composed of several highly diversified conglomerates with global operations, including Mitsubishi Corporation, Itochu Corporation, Marubeni Corporation, and Sumitomo Corporation. While these companies share common roots and business models, each has adopted a distinct strategic posture based on capital allocation, sector focus, and growth orientation. The following comparison highlights the unique positioning of Mitsui & Co. relative to its key competitors.

Major Competitor Profiles

Mitsubishi Corporation

Maintains a well-balanced portfolio with meaningful contributions from energy, metals, and consumer sectors.

LNG and upstream energy remain core pillars, supported by prudent risk controls and stable returns.

Digital strategy is internally focused, emphasizing operational efficiency over disruptive innovation.

Capital policy is conservative, prioritizing long-term shareholder value with stable dividends and selective buybacks.

Itochu Corporation

Strongest consumer orientation among peers, with limited exposure to commodity markets.

Operates leading domestic brands including FamilyMart and Descente; excels in textiles and food logistics.

Digitally advanced in retail systems and data analytics.

Known for shareholder-friendly governance, high ROE, and aggressive capital returns.

Marubeni Corporation

Historically resource-centric but actively rebalancing toward infrastructure and agri-food sectors.

Scaling down fossil fuel exposure while increasing investments in renewable energy.

Digital strategy remains nascent; focused more on selective transformation.

Capital discipline is improving post-restructuring, with a rising payout ratio.

Sumitomo Corporation

Broadly diversified across resources, transportation, construction, and consumer segments.

Recovery-oriented strategy following impairments in prior cycles.

Relatively cautious approach to innovation and growth investments.

Dividend policy is stable but less dynamic compared to peers.

Mitsui & Co.: Strategic Positioning

Key Strengths

Energy Transition Leadership: Operates one of the most globally integrated LNG portfolios, and is proactively investing in next-generation fuels such as hydrogen and ammonia.

Healthcare Differentiation: Ownership stake in IHH Healthcare provides unmatched exposure to Asia’s growing medical infrastructure market.

Innovation Capability: A dedicated business segment focused on monetizing digital assets through AI, logistics platforms, and venture capital.

Balanced Global Footprint: Strong presence across developed and emerging markets enables resilient earnings across cycles.

Capital Allocation Discipline: Demonstrates consistent ROE above 12%, with a progressive dividend policy and active share repurchase program.

Relative Weaknesses

Commodity Cyclicality: High exposure to energy and metals introduces earnings volatility.

Execution Complexity: Broad operational scope requires strong coordination and governance to ensure alignment.

Consumer Brand Visibility: Compared to Itochu, Mitsui has less direct exposure to consumer retail brands in Japan.

Strategic Differentiation

Versus Mitsubishi: Mitsui exhibits greater risk appetite in external innovation and healthcare, whereas Mitsubishi maintains strength in capital preservation and upstream stability.

Versus Itochu: Mitsui is more globally diversified and industrial in orientation, while Itochu leverages its domestic consumer franchise and governance excellence.

Versus Marubeni: Mitsui retains meaningful energy exposure but complements it with growth in clean fuels and digital platforms.

Versus Sumitomo: Mitsui has demonstrated faster strategic execution and greater ambition in emerging sectors.

Overall, Mitsui’s strategic approach strikes a balance between resource-driven stability and future-oriented investments, positioning it as a structurally differentiated player in Japan’s trading house landscape.

8. Conclusion and Valuation Perspective

Mitsui & Co. has demonstrated superior strategic adaptability and financial robustness across multiple business cycles. The company’s well-diversified portfolio, spanning energy, healthcare, infrastructure, and digital platforms, has enabled it to deliver both stability and upside potential. Importantly, Mitsui’s differentiated approach—balancing traditional strengths in resource trading with growth-oriented investments in healthcare (IHH), AI-driven logistics, and clean energy—positions it as a structurally unique player in the sogo-shosha universe.

Its capital allocation discipline is notable: a ROE consistently above 12%, a payout ratio exceeding 35%, and regular share buybacks signal a shareholder-aligned philosophy. Meanwhile, the company’s proactive stance in monetizing energy transition technologies, including hydrogen, ammonia, and carbon capture and storage (CCS), gives it a first-mover advantage in decarbonization.

On the valuation front, Mitsui trades at a PER of ~11.2x and a PBR of ~1.3x, which remains compelling given its profitability metrics, strategic visibility, and global footprint. The dividend yield of ~2.9%, backed by ample free cash flow, adds further support for income-oriented investors.

Peer Comparison Summary

Versus Mitsubishi: Mitsui offers greater exposure to healthcare and external innovation

Versus Itochu: Mitsui is more globally industrial and diversified

Versus Marubeni / Sumitomo: Mitsui provides stronger execution and higher optionality in growth sectors

Final Takeaway

In summary, Mitsui stands out as a uniquely positioned Japanese trading company, blending traditional stability with forward-leaning innovation and global scale. Its business model offers both dependable cash flows and long-term growth drivers.

Investment Consideration

Given its attractive valuation, strong capital efficiency, and differentiated growth strategy, Mitsui & Co. may be well-suited for long-term investors seeking exposure to Japan’s industrial base and global innovation themes. While short-term earnings remain sensitive to commodity cycles, the company’s diversified cash flow profile and forward-looking initiatives could support sustained value creation over time. Investors may consider Mitsui as a potential core holding within a diversified Japan equity allocation, depending on individual risk tolerance and investment objectives.

At Wasabi Info, we publish concise equity reports and market insights through our blog, and also provide custom, tailor-made research to support strategic decision-making for both private investors and corporations.

Our research services include:

• Equities: In-depth analysis of Japan-listed companies not featured in the blog

• Competitor Analysis: Detailed mapping of industry rivals and market dynamics

• Market Entry Intelligence: Insights into local barriers, regulations, and competitor positioning

• Real Estate & Assets: Localized assessments for factory, hotel, or retail expansion

• Field Intelligence: On-the-ground surveys and discreet market checks unavailable through public sources

Reports are available in English, Chinese, and Japanese.

For inquiries, please contact: admin@wasabi-info.com

© Wasabi Info | Privacy Policy

Disclaimer

This report is provided for informational purposes only and does not constitute investment, legal, or tax advice.

The analysis may include forward-looking statements and interpretations based on publicly available information as of the date of writing.

Readers are solely responsible for their own investment decisions and should seek advice from a licensed financial advisor or other qualified professional.

Wasabi-Info.com makes no representation or warranty, express or implied, regarding the accuracy, completeness, or reliability of the information contained herein, and shall not be held liable for any loss or damage arising from the use of this report.