Nissin Foods Holdings Co., Ltd. (TSE: 2897) — 2025 Equity Analysis Report

1. Introduction

Nissin Foods Holdings Co., Ltd. (TSE: 2897) is a global leader in instant noodles and packaged food innovation, best known for its invention of instant ramen. The company has steadily evolved into a diversified food conglomerate with a presence in over 20 countries. With its vision as an EARTH FOOD CREATOR, Nissin pursues sustainable growth through global expansion, product innovation, and ESG-conscious practices.

2. Stock Price Development

5-Year Performance Overview

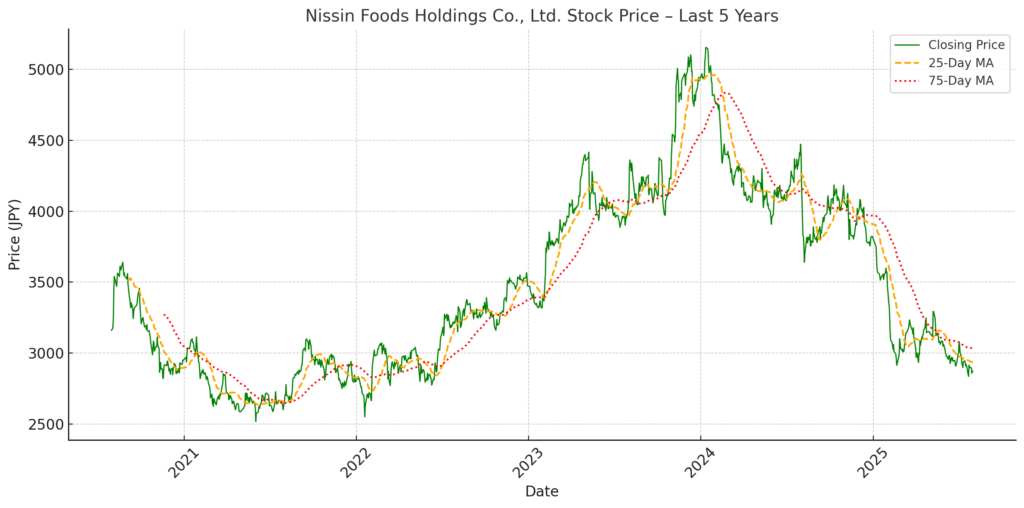

Over the past five years, Nissin Foods Holdings has experienced a full market cycle — transitioning from steady growth to a sharp correction. After reaching a historical high of approximately ¥5,100 in late 2023, the stock has steadily declined to around ¥2,900 as of July 2025, marking a decline of more than 40% from peak levels.

The trajectory can be segmented into three distinct phases:

| Period | Trend | Commentary |

|---|---|---|

| 2020–2022 | Gradual uptrend | Fueled by pandemic-driven demand and margin expansion in Japan |

| 2023 | Sharp rally into late 2023 | Driven by strong earnings, aggressive buybacks, and “Complete Meals” product buzz |

| 2024–2025 | Prolonged decline | Marked by operational headwinds and profit-taking post stock split |

| Date | Event | Market Reaction |

|---|---|---|

| Dec 2023 | Peak near ¥5,100 | Overbought conditions + valuation stretched |

| Jan 2024 | Stock split (3-for-1) | Initial optimism faded; post-split sell-off began |

| Feb–May 2024 | Weak FY2024 guidance | U.S. cost pressures, no EPS upside → share price dropped below ¥4,000 |

| Aug 2024 | Q1 FY2025 earnings miss | Overseas margin deterioration, muted domestic sales |

| Mar–Jul 2025 | Technical downtrend | 25-day MA crossed below 75-day MA (death cross), weak sentiment persists |

Observations on the Downtrend (2024–2025)

Margin Pressure in Americas: A key source of decline. Nissin’s U.S. business has been facing labor and freight cost inflation, dragging down consolidated operating margins.

Post-Split Profit-Taking: After the 3-for-1 stock split, individual investors rushed in, but institutional holders began selling on valuation concerns. The result was increased volatility.

Valuation Compression: From a peak P/E above 25x, the stock now trades closer to 17–18x forward earnings, indicating a sentiment shift from growth optimism to defensive positioning.

Low Trading Volumes: Compared to 2023, average daily trading volume has declined, suggesting weakened investor enthusiasm and a wait-and-see approach.

Summary Insight for Investors

“Nissin’s share price decline since early 2024 reflects a classic mean-reversion following euphoric highs. While the fundamentals remain intact, operational hiccups and valuation normalization have reset market expectations. For long-term investors, this may represent a re-entry opportunity — contingent on margin recovery and sustained innovation momentum.”

3. Financial and Operational Analysis

3.1 Key Financial Metrics (Consolidated)

| Fiscal Year End | Revenue (bn JPY) | Net Profit (bn JPY) | ROE (%) | EPS (JPY, post-split) | PER (x) |

|---|---|---|---|---|---|

| 2021/3 | 506.1 | 40.8 | 11.5 | ~130.7 | 20.9 |

| 2022/3 | 569.7 | 35.4 | 8.9 | ~114.5 | 24.9 |

| 2023/3 | 669.2 | 44.8 | 10.7 | ~146.9 | 27.5 |

| 2024/3 | 732.9 | 54.2 | 11.7 | 178.2 | 23.6 |

| 2025/3 | 776.6 | 55.0 | 11.4 | 184.4 | 16.6 |

3.2 Observations

Revenue and profit have consistently reached record highs, despite global macro uncertainty.

ROE remains stable above 11%, exceeding the estimated capital cost (~6%).

FY2025 saw continued top-line growth, although margin expansion was modest.

PER has compressed to ~16.6x — indicating a valuation correction rather than structural weakness.

4. Strategic and Technological Positioning

Vision and Corporate Philosophy

Nissin Foods defines itself as an “EARTH FOOD CREATOR”, a concept rooted in the belief that “peace will come to the world when there is enough food”. This philosophical foundation drives not only its instant noodle business, but also its increasing commitment to nutrition, sustainability, and global food security.

Mid-to-Long-Term Strategy: “Nissin Group Vision 2030”

This vision outlines three strategic pillars for growth and transformation:

| Pillar | Description | Examples |

|---|---|---|

| 1. Strengthen Core Cash-Generating Businesses | Improve profitability and market share in instant noodles and chilled foods | Premium product expansion, manufacturing automation |

| 2. EARTH FOOD CHALLENGE 2030 (Sustainability) | Reduce environmental footprint and improve supply chain resilience | Biodegradable packaging, GHG reduction targets |

| 3. Create Future Growth Engines | Explore new categories and health-oriented segments | “Complete Nutrition Meals” (完全メシ), M&A in plant-based sectors |

This framework represents a balanced strategy between stability, responsibility, and innovation.

Global Portfolio Positioning

Nissin’s business is geographically diversified:

Japan (Domestic): Still contributes ~47% of revenue. Market is mature but stable. Profit margins remain high.

Overseas Markets: Contribute over 50% of revenue, with high growth in:

Asia (China, Southeast Asia) – Double-digit growth in cup noodle demand

EMEA (Europe, Middle East, Africa) – Focused on halal-certified production and local partnerships

Americas – Facing margin pressure from logistics and input costs, but strong brand equity via “Cup Noodles” and “Top Ramen”

The company aims to increase overseas revenue share to 60% by FY2030.

Innovation in Nutrition and Food Technology

| Initiative | Description | Strategic Value |

|---|---|---|

| “Complete Nutrition Meals” (完全メシ) | Meals designed to provide all essential nutrients | Captures health-conscious and time-starved consumers |

| “Nissin Smart Factory” | Automation and digitization of manufacturing lines | Enhances cost efficiency and quality consistency |

| Food Tech R&D | Joint research with universities (e.g., Osaka University) | Developing next-gen noodles, plant-based proteins |

These initiatives highlight Nissin’s shift from low-cost carb supplier to premium nutrition innovator.

ESG and Sustainability Commitment

Nissin’s “EARTH FOOD CHALLENGE 2030” includes:

| Theme | Target |

|---|---|

| Environmental | Net-zero emissions (Scope 1 and 2) by 2050, 30% reduction by 2030 |

| Packaging | 100% recyclable/biodegradable packaging by 2030 |

| Social | Improve food security via education, disaster response food stockpiling |

| Governance | TSR-based executive compensation, enhanced transparency in ESG KPIs |

These efforts appeal to ESG-focused investors, particularly in Europe and North America.

Strategic Differentiators vs. Peers

| Factor | Nissin | Maruchan (Toyo Suisan) | Nongshim (Korea) |

|---|---|---|---|

| Innovation Branding | High (Complete Meals, Smart Factory) | △ Moderate | △ Low |

| ESG Strategy | Advanced and quantified | △ Basic disclosure | △ Limited |

| Global Presence | Diversified across Asia, EMEA, Americas | △ Asia-heavy | △ Korea/China-centric |

| Product Premiumization | Ongoing (Cup Noodle Pro, Luxury Line) | △ Low-end focus | △ Mixed |

Nissin is positioned as the global premium instant food innovator, while many competitors remain price-driven regional players.

Summary Insight for Investors

“Nissin Foods is strategically transforming itself from a mass instant noodle manufacturer into a global innovator in sustainable and nutritious food. Its multi-layered strategy of market expansion, health-driven product development, and environmental leadership positions it uniquely among global food stocks.”

5. Risks and Catalysts

5.1 Catalysts — Upside Triggers for Share Price

| Catalyst | Explanation | Expected Impact |

|---|---|---|

| 1. Recovery in U.S. Operations | Profit margin in the Americas dropped in FY2024 due to high transportation and warehousing costs. Nissin has announced logistics optimization and automation measures in FY2025–2026. | Operating margin recovery in overseas business (currently ~5%) could lead to earnings surprises. |

| 2. Continued Shareholder Returns | Large-scale buybacks (¥400B in FY2024, ¥200B in FY2025) and stable dividends contribute to high TSR (Total Shareholder Return). | Helps support the share price during market corrections and maintains valuation floor. |

| 3. Weakening JPY (vs USD, CNY) | A weaker yen boosts overseas earnings (over 50% of consolidated revenue is from overseas). | FX tailwind could enhance EPS and profitability in quarterly disclosures. |

| 4. Product Innovation and “Complete Meals” | Expansion of “完全メシ (Complete Nutrition Meals)” targets health-conscious demographics. | Market expansion into premium and functional food segments increases top-line growth potential. |

| 5. ESG-Focused Fund Inflows | As ESG metrics improve (GHG targets, biodegradable packaging), institutional inflows from ESG-themed funds (especially in Europe) may increase. | Enhances global visibility and supports valuation multiple expansion. |

| 6. Potential Strategic M&A | The company has announced plans to invest in new food tech and overseas brands by 2030. | Well-timed acquisitions can boost presence in ASEAN or alternative protein space. |

These catalysts have both financial and narrative power — strengthening Nissin’s investment case in global defensive growth portfolios.

5.2 Risks — Potential Downside Factors

| Risk | Explanation | Severity |

|---|---|---|

| 1. Raw Material Cost Volatility | Palm oil, wheat, and plastic resin prices remain volatile due to geopolitical issues and climate conditions. | High – Can compress gross margins if costs rise faster than price pass-through. |

| 2. Margin Pressure in Americas | Persistent cost issues in the U.S. due to labor shortages and fuel inflation continue to weigh on profits. | Moderate – Although improving, full recovery may take time. |

| 3. Geopolitical Risks in Asia | China accounts for ~15% of overseas revenue. Trade tensions or regulatory actions could hurt growth. | Moderate – Market sentiment sensitive to Asia exposure. |

| 4. Sector Rotation Out of Consumer Staples | In bull markets, investors tend to rotate capital away from defensive stocks like food companies. | Moderate – Valuation compression not tied to fundamentals. |

| 5. Innovation Execution Risk | “Complete Meals” and Smart Factory automation are ambitious, but may face adoption or cost hurdles. | Low–Moderate – Key to future growth, but not core earnings yet. |

| 6. FX Appreciation of JPY | Yen strength due to global interest rate cycles can hurt earnings translated from USD/CNY. | Low – But relevant for short-term earnings guidance. |

Nissin’s risk profile is relatively low compared to industrials or tech, but margin compression and FX trends need close monitoring.

Risk–Reward Summary Matrix

| Factor | Near-Term Impact | Long-Term Impact | Investor Sensitivity |

|---|---|---|---|

| FX volatility | Positive if JPY weakens | Neutral | High |

| ESG progress | Neutral | Positive (long-term flows) | Moderate |

| Innovation ramp-up | Uncertain | High upside | High |

| Commodity costs | High risk | Neutral | Very high |

Summary Insight for Investors

“Nissin offers a favorable risk-reward profile with multiple upside catalysts in place—logistics recovery, yen tailwinds, and premium product expansion—while risks like raw material costs and margin pressure remain manageable within a defensive sector. Its diversified global footprint and ESG initiatives make it a compelling candidate for global equity portfolios.”

6. Conclusion

Despite the stock’s decline since early 2024, Nissin Foods remains fundamentally strong with solid earnings, a healthy balance sheet, and consistent shareholder returns. The current valuation (PER ~16.6x) appears attractive relative to both historical levels and sector peers.

For long-term investors seeking exposure to Japan’s resilient consumer staples and a globally expanding food innovator, Nissin Foods offers a compelling entry point. However, macro risks and execution in overseas markets warrant continued monitoring.

At Wasabi Info, we publish concise equity reports and market insights through our blog—

but our core value lies in providing bespoke, on-demand research for international clients.

Whether you are a private investor or a corporation, we deliver confidential, tailored intelligence designed to support strategic decisions.

Our research services include:

• Equities: In-depth analysis of Japan-listed companies not featured in the blog

• Competitor Analysis: Detailed mapping of industry rivals and market dynamics

• Market Entry Intelligence: Insights into local barriers, regulations, and competitor positioning

• Real Estate & Assets: Localized assessments for factory, hotel, or retail expansion

• Field Intelligence: On-the-ground surveys and discreet market checks unavailable through public sources

Reports are available in English, Chinese, and Japanese.

For inquiries, please contact: admin@wasabi-info.com

© Wasabi Info | Privacy Policy

Disclaimer

This report is intended for informational purposes only and does not constitute investment advice. The analysis contains forward-looking statements and interpretations based on publicly available information as of the date of writing. Readers should conduct their own research and consult with a licensed financial advisor before making any investment decisions. Wasabi-Info.com shall not be held liable for any loss or damage arising from the use of this report or reliance on its contents.