TOYO TANSO CO., LTD. (TSE: 5310): Stock Analysis

September 23, 2025

1. Introduction

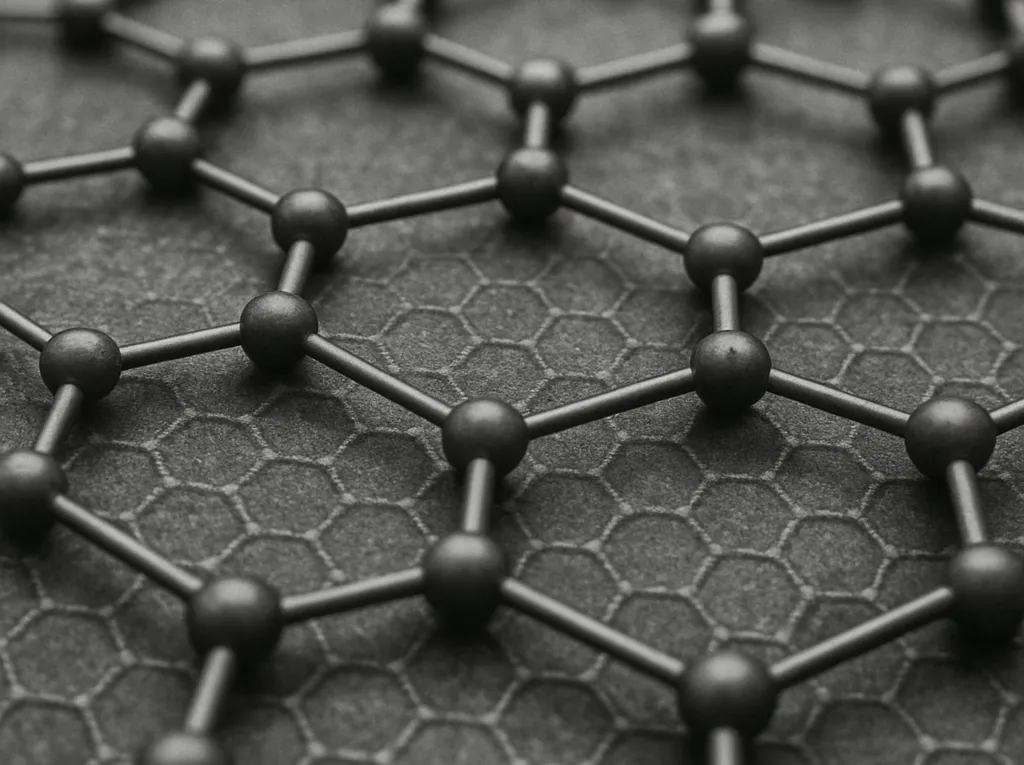

Toyo Tanso Co., Ltd. is a global pioneer in the development and mass production of isotropic graphite and advanced carbon materials. Headquartered in Osaka, the company plays a vital role across several high-tech sectors including semiconductors, EVs, renewable energy, aerospace, and nuclear power.

Since introducing the world’s first isotropic graphite in 1974, Toyo Tanso has leveraged its proprietary technologies to establish dominant positions in key markets such as silicon wafer processing equipment, SiC epitaxial systems, and high-temperature furnaces. Its vertically integrated production in Japan and global direct-sales network enable high quality, traceability, and deep customer engagement.

2. Stock Price Performance

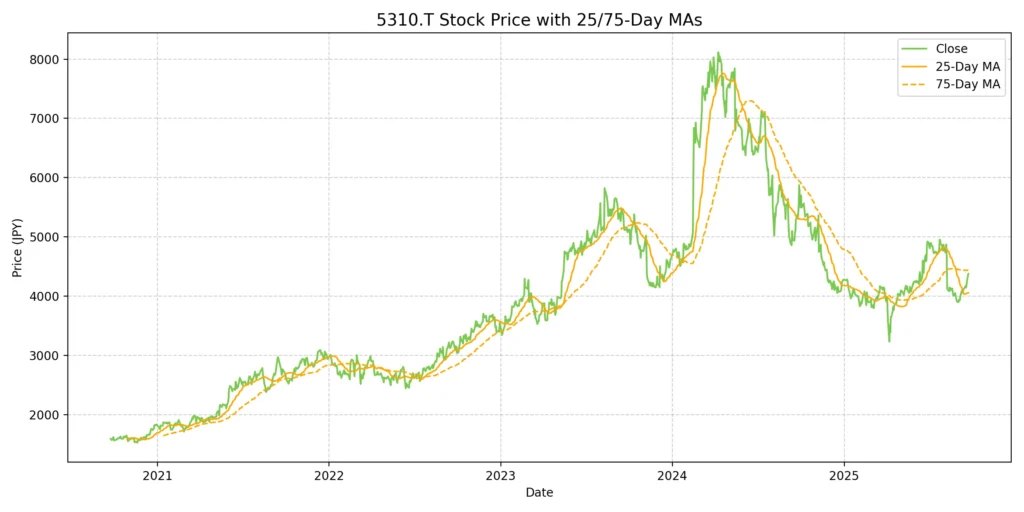

Toyo Tanso’s share price has experienced significant volatility over the past three years, reflecting cyclicality in semiconductor capital spending and investor expectations for SiC power device growth. After a sharp rally through 2023 and into early 2024, the stock saw a notable correction in 2025 due to earnings downgrades and weaker demand in core end markets.

| Year | Low (¥) | High (¥) | Remarks |

|---|---|---|---|

| 2022 | 2,605 | 4,030 | Recovery phase amid early semiconductor upcycle |

| 2023 | 3,525 | 6,390 | Driven by robust earnings and SiC optimism |

| 2024 | 4,165 | 8,480 | All-time high during peak semiconductor capex cycle |

| 2025 | 3,120 | 5,020 | Corrected sharply after earnings downgrade and demand softness |

As of September 23, 2025, the stock trades at approximately ¥4,300–¥4,400, significantly below its all-time high of ¥8,480 set in 2024 and also below its 2025 peak of ¥5,020 (June 2025). The share price has declined ~47% from the 2024 peak and ~14% from the 2025 high, reflecting investor caution over cyclical demand in semiconductors and electric vehicles.

Key Observations:

The stock is currently ~47% below its 2024 high, reflecting semiconductor and EV-related softness.

2025 price action shows a high-to-low range of approximately 49%, underscoring sector cyclicality.

Despite this correction, the stock price remains structurally higher than its pre-2022 levels, with long-term growth themes intact.

Valuation multiples have slightly expanded due to lower FY2025 earnings, but medium-term catalysts remain strong (SiC, nuclear, high-temp composites).

3. Financial and Operational Performance

| Fiscal Year | Revenue (¥ mn) | Operating Profit | Ordinary Profit | Net Income | EPS (¥) | DPS (¥) |

|---|---|---|---|---|---|---|

| 2022 | 43,774 | 6,667 | 7,369 | 5,181 | 247.1 | 70 |

| 2023 | 49,251 | 9,283 | 10,182 | 7,506 | 357.9 | 110 |

| 2024 | 53,093 | 12,238 | 13,480 | 9,960 | 474.95 | 145 |

Revenue and Growth Trends

Revenue CAGR (2022–2024): ~10.1%, driven by strong demand from semiconductor equipment (Si and SiC wafer production) and steady expansion in high-performance carbon products.

Growth was not only volume-driven but also benefited from product mix improvements—specifically the shift toward SiC-coated graphite susceptors and C/C composites with higher ASPs (Average Selling Price).

Global sales grew across regions, particularly in Asia and North America, where demand from EV-related and clean energy sectors accelerated.

Profitability: Margin Expansion and Operational Leverage

Operating profit margin improved markedly:

FY2022: 15.2%

FY2023: 18.8%

FY2024: 23.0%

This reflects:

Economies of scale from higher utilization rates

Increased contribution from high-margin consumables for semiconductor manufacturing

Pricing power through differentiated materials (e.g., isostatic graphite, SiC coatings)

Cost discipline: SG&A as % of sales remained stable despite expansion, suggesting strong cost control mechanisms.

Net Income and Capital Efficiency

Net income nearly doubled, from ¥5.2 bn to ¥10.0 bn in just 2 years.

ROE rose from 6.9% (2022) to 11.2% (2024), indicating both profitability and efficient capital deployment.

Net margin expanded from 11.8% (2022) → 18.8% (2024), showing strong bottom-line leverage.

Financial Health: Capital Structure and Stability

The company maintained an equity ratio above 80%, underlining a conservative, cash-rich balance sheet.

Minimal interest-bearing debt, high retained earnings, and consistent positive operating cash flow contribute to low financial risk.

Inventory and CAPEX were well-managed despite expansion projects; no signs of overbuilding or working capital stress.

Shareholder Returns

DPS increased from ¥70 (2022) to ¥145 (2024), more than doubling in line with net profit growth.

Dividend payout ratio remained in the 33–34% range, consistent with the company’s official target of “≥30%”.

The consistent dividend hike without resorting to special dividends or unsustainable payout ratios demonstrates prudent capital return policy.

Summary Table: Key Financial Ratios

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Operating Margin | 15.2% | 18.8% | 23.0% |

| Net Margin | 11.8% | 15.2% | 18.8% |

| ROE | 6.9% | 9.3% | 11.2% |

| Payout Ratio | 25.2% | 33.2% | 34.0% |

| Equity Ratio | >80% | >80% | >80% |

Strategic Implications

Toyo Tanso’s profitability expansion reflects more than just a semiconductor upcycle—it indicates a successful strategic repositioning toward high-performance, value-added carbon products.

The balance of growth, profitability, and capital discipline reinforces its status as a structurally attractive compounder in the advanced materials sector.

As of FY2024, the company is entering FY2025 with a strong earnings base and clean balance sheet, providing optionality for strategic investments, R&D, and further shareholder return enhancements.

4. Business Segments and Strategy

Toyo Tanso operates across three main product segments, each serving critical roles in high-growth industries such as semiconductors, electric vehicles (EVs), renewable energy, aerospace, and advanced medical technologies. The company’s strategy is centered on expanding its leadership in high-purity, high-performance carbon materials, particularly where durability, heat resistance, and precision are essential.

1. Specialty Graphite Products (~45% of revenue)

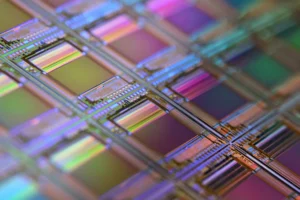

Main Applications: Semiconductor manufacturing equipment (Si and SiC wafer processing)

These are ultra-high-purity, fine-grain graphite components used in high-temperature environments—most notably in semiconductor fabrication processes such as:

Crystal growth furnaces for silicon (Si) wafers

Epitaxial reactors for silicon carbide (SiC) power semiconductors

Key Characteristics:

Heat resistance >2,000°C

Exceptional dimensional stability

High purity (to avoid contamination of wafers)

Why it matters:

Toyo Tanso holds a top global share in graphite components for pull-up furnaces used to make single-crystal silicon—a foundational material for all chips. It is also expanding in SiC-related parts, which are critical for next-gen EV power devices due to their high voltage resistance and energy efficiency.

Investor insight:

As demand for AI, 5G, and EVs grows, so does the need for more advanced, defect-free semiconductors. Toyo Tanso’s products are “consumables” that must be replaced regularly, creating recurring demand with high margins.

2. General Carbon Products (~15–20%)

Main Applications: Industrial motors, railways, renewable energy equipment

Includes:

Carbon brushes: transfer electricity in motors

Mechanical seals: used in pumps

Pantograph strips: conduct current in electric trains

Carbon bearings: found in harsh environments like wind turbines or chemical plants

Why it matters:

These products are mature but stable. While lower-margin than specialty graphite, they provide consistent cash flow and serve as a platform to cross-sell advanced materials to industrial clients.

Investor insight:

This segment offers downside protection during semiconductor slowdowns, and overlaps with infrastructure and renewable energy trends.

3. Composites and Others (~35%)

Main Applications: EVs, aerospace, nuclear reactors, medical devices

Products include:

C/C composites (carbon fiber reinforced carbon):

Used in aerospace brakes, high-temp furnace partsSiC-coated graphite (susceptors):

A key material in SiC epitaxial growth equipmentGraphite sheets & powders:

Used in batteries, solar cells, and shielding applications

What makes this special:

These are engineered carbon products that combine strength, heat resistance, and chemical inertness. For example:

In EVs, C/C composites can handle intense braking heat or high-current battery environments.

In SiC semiconductors, SiC-coated graphite offers both heat durability and chemical compatibility during wafer production.

In nuclear reactors, high-purity graphite acts as neutron moderators or heat shields in high-temperature gas reactors (HTGRs).

Investor insight:

This is Toyo Tanso’s most dynamic segment. It addresses secular growth markets (EVs, clean energy, nuclear, aerospace), with higher technical complexity and ASPs. Mid-term strategy aims to double revenue in this segment by FY2029.

Strategic Roadmap: 2025–2029 Vision

Toyo Tanso’s mid-term plan targets the following by FY2029:

| Target | Goal |

|---|---|

| Revenue | ¥82 billion |

| Operating Profit | ¥22 billion |

| Operating Margin | 27% |

| ROE | ≥12% |

| Cumulative CapEx | ¥57 billion |

Key Growth Strategies:

Expand high-margin consumables:

→ Focus on SiC epitaxial components, C/C composites, and graphite coatingsCapitalize on energy transition:

→ Graphite materials for EVs, hydrogen, solar, and nuclearStrengthen global presence:

→ Shift from export-heavy model to more localized processing hubs (Asia, Europe, US)Sustain R&D leadership:

→ Enhanced by new headquarters facility and collaborations with academiaSustain shareholder returns:

→ Stable dividend policy (≥30% payout), with potential for upside in strong earnings years

5. Investment Outlook and Catalysts

Toyo Tanso is strategically positioned to benefit from multiple secular trends in the global economy—particularly those driven by digitalization, electrification, energy transition, and national security concerns. Its core products serve as enabling materials in mission-critical environments, where carbon’s unique properties (light weight, heat resistance, chemical stability) cannot be easily replaced.

Growth Drivers

1. Semiconductor Demand (AI, Data Centers, 5G)

What’s happening: Global demand for advanced semiconductors continues to rise, driven by AI computing, cloud data centers, and 5G infrastructure.

Toyo Tanso’s role: The company provides graphite parts for the furnaces used to make silicon wafers. These parts operate in ultra-high-temperature, ultra-clean environments, where ordinary materials like metal would melt or contaminate the chip.

Why it matters: As chips become more advanced (e.g., for AI), production precision increases—and so does the demand for high-performance carbon consumables.

2. SiC Power Devices (Electric Vehicles, Renewable Energy)

What’s SiC?: Silicon carbide (SiC) is a next-gen semiconductor used in high-voltage, high-efficiency power devices, especially in electric vehicles (EVs), solar inverters, and smart grids.

Toyo Tanso’s role: They supply SiC-coated graphite components for the special reactors that produce SiC wafers.

Why it matters: SiC is rapidly replacing traditional silicon in EVs and energy tech. As production of SiC devices scales, consumption of Toyo Tanso’s SiC-related parts grows proportionally.

3. Advanced Carbon Composites (C/C)

What are they?: C/C = carbon fiber reinforced carbon. Think of it as “carbon armor”—stronger and more heat-resistant than metals, yet light and corrosion-proof.

Applications:

EV brakes and battery casings

Aerospace furnace components

Industrial heat treatment equipment

Why it matters: As industries move toward higher efficiency and lighter materials, demand for C/C is expanding. Toyo Tanso’s ability to produce these complex materials in Japan is a competitive advantage.

4. Nuclear Energy (HTGRs)

Context: Japan and Europe are restarting or expanding High-Temperature Gas-cooled Reactors (HTGRs) as part of their decarbonization and energy security strategies.

Toyo Tanso’s role: They provide special graphite blocks used to control nuclear reactions and resist radiation.

Why it matters: Unlike legacy reactors, HTGRs operate at 700–950°C, requiring materials like ultra-pure graphite that can survive intense heat and maintain structural integrity.

Upcoming Catalysts (Near- to Mid-Term Events to Watch)

1. Semiconductor Capex Recovery from FY2026

Major foundries and equipment makers (TSMC, ASML, Tokyo Electron) have signaled a bottoming of the semiconductor capex cycle.

Toyo Tanso’s consumables are directly tied to capex activity, especially in SiC and silicon wafer production.

2. SiC Equipment Adoption

As SiC becomes the new standard for EVs and renewables, demand for SiC epitaxy reactors—and the graphite inside them—will surge.

Toyo Tanso is already a qualified supplier for multiple reactor manufacturers.

3. Stronger Capital Returns (Dividends/Buybacks)

FY2024 marked record earnings and a ¥145 dividend (up from ¥70 in FY2022).

If FY2026 sees earnings rebound post-downcycle, management could resume dividend hikes or introduce stock buybacks—particularly given the firm’s net cash position and 80%+ equity ratio.

4. Japanese Government Incentives

Toyo Tanso qualifies under Japan’s push for “strategic high-value materials” production.

Government programs are encouraging domestic carbon material development, reshoring of supply chains, and clean-energy tech—all of which support Toyo Tanso’s capex and R&D roadmap.

Strategic Summary for Investors

Toyo Tanso is not merely a cyclical materials play—it is a structural beneficiary of long-term transformations in power, mobility, and computing. While short-term earnings may soften with the semiconductor cycle, the company’s technology moat, balance sheet strength, and focus on mission-critical carbon materials make it well-positioned to outperform across the next industrial cycle.

6. Risks

While Toyo Tanso benefits from long-term structural demand in semiconductors, EVs, and energy transition technologies, its business model is not without risk. Below is a breakdown of both general industry risks and company-specific vulnerabilities that investors should monitor.

1. Semiconductor and Capex Cyclicality

Risk: Semiconductor manufacturing is a highly cyclical industry, driven by capex booms and busts.

Impact: Toyo Tanso’s specialty graphite products—particularly for crystal growing and epitaxial equipment—are heavily exposed to front-end semiconductor fab investment. A pause in new equipment orders can sharply reduce graphite consumables demand.

Recent Example: The 2025 slowdown in SiC tool shipments contributed to lower YoY growth.

2. Customer Concentration in High-Tech Equipment

Risk: A limited number of semiconductor tool manufacturers and foundries account for a disproportionate share of Toyo Tanso’s revenue, especially in the Specialty Graphite segment.

Impact: A delay, production cut, or shift in design specs by one or two major customers (e.g., SiC reactor OEMs, wafer makers) could materially affect revenue.

Hidden Vulnerability: Many of these customers are not disclosed by name, but dependency on specific SiC tool geometries or design compatibility could create product-level dependency risk.

3. Product Approval and Switching Risk

Risk: In high-tech industries, customers require strict qualification processes before adopting materials like graphite components.

Impact: While this provides a moat, it also creates risk of exclusion if a competitor offers better price/performance or if the customer redesigns its system.

Example: If a major foundry switches to a different susceptor material or coating method, Toyo Tanso could lose business even with strong performance history.

4. Manufacturing Scale Constraints

Risk: Toyo Tanso’s advanced graphite products are manufactured via multi-month, high-temperature processes requiring precise control (isostatic pressing, graphitization, coating, machining).

Impact: Production capacity cannot be scaled quickly, and ramping up requires both time and capital. This limits the company’s ability to respond to sudden demand surges, leading to missed revenue opportunities or customer dissatisfaction.

Strategic Implication: The ¥57 bn mid-term CapEx plan (2025–2029) helps, but execution delays or cost overruns could materially affect growth targets.

5. Geopolitical and Trade Risk

Risk: Toyo Tanso exports highly specialized materials globally. Semiconductor and nuclear-related exports are increasingly subject to regulatory scrutiny, particularly between Japan, China, the U.S., and EU.

Impact:

Risk of export restrictions (e.g., U.S.-aligned controls on advanced materials to China)

Risk of customer delays or cancellations due to cross-border tensions

Increased localization pressure could raise operational complexity and costs

6. Foreign Exchange (FX) Volatility

Risk: While most production occurs in Japan, Toyo Tanso earns a significant portion of revenue in USD, EUR, CNY, and other currencies.

Impact: A strong yen reduces the value of overseas earnings and weakens export competitiveness. While some natural hedging exists via procurement, FX remains a source of earnings fluctuation.

Mitigation: The company engages in partial hedging, but is still exposed to sudden JPY appreciation.

7. Material and Energy Cost Volatility

Risk: Raw materials for graphite production (e.g., petroleum-based coke) and energy (especially electricity for graphitization) are price-volatile and energy-intensive.

Impact: Unexpected spikes in input costs can compress margins, especially in fixed-price long-term contracts.

Context: Carbon neutrality regulations may also lead to higher environmental compliance costs for energy-intensive plants.

8. Technology Obsolescence and Substitution

Risk: While carbon materials are highly durable and niche, new materials (e.g., advanced ceramics, SiN, sapphire, sintered metals) may offer alternatives depending on temperature, purity, and performance requirements.

Impact: Loss of technological edge, especially in SiC-related or C/C composite markets, could erode pricing power or replaceability.

Note: Toyo Tanso invests heavily in R&D, but timing and market acceptance of innovations remain uncertain.

9. Management Execution Risk

Risk: Toyo Tanso has a technically oriented corporate culture. While this drives product excellence, it may lead to conservative decision-making, slower global expansion, or less aggressive capital returns compared to peers.

Impact: Execution gaps in localization, marketing, or capacity planning could delay mid-term plan goals.

Investor concern: Limited disclosure on specific customer wins, contract durations, or regional breakdowns can reduce transparency for shareholders.

7. Conclusion

Toyo Tanso stands at a strategic intersection of multiple high-growth sectors—semiconductors, electric mobility, next-generation energy, and advanced nuclear technology. With a long track record in developing high-purity, high-temperature carbon materials, the company serves critical roles in manufacturing processes where conventional materials cannot withstand the demands of heat, chemical stability, or dimensional precision.

Between FY2022 and FY2024, the company more than doubled its net income, while operating margin expanded from 15.2% to 23.0%. This performance was achieved not merely through end-market growth, but via a successful product mix shift toward SiC-coated graphite, carbon-carbon composites, and other high-value consumables.

As of September 23, 2025, the company’s share price stands at approximately ¥4,380. Based on FY2024 earnings per share of ¥474.95, this equates to a trailing PER of approximately 9.2 times. Book value per share (BPS) as of FY2024 was ¥4,489, placing the current PBR at approximately 0.98 times. These multiples remain conservative, particularly for a company with a net-cash balance sheet, a return on equity (ROE) of 11.2%, and a stable dividend payout ratio in the range of 33–34%.

The subdued valuation likely reflects investor caution around short-term earnings normalization, particularly following the peak demand phase in semiconductors and SiC tools in FY2024. Indeed, earnings for FY2025 are expected to decline year-on-year due to a temporary pullback in capital spending across major end-markets. However, this weakness is widely seen as cyclical, with most forecasts pointing to a recovery in semiconductor capex beginning in FY2026.

Beyond the immediate cycle, structural drivers remain intact. Electrification in mobility and power, growing adoption of SiC-based power devices, and the gradual revival of nuclear energy infrastructure—especially high-temperature gas reactors (HTGRs)—are all themes that align with Toyo Tanso’s material portfolio. In parallel, government incentives for strategic material development and reshoring efforts in Japan and abroad could provide additional support to long-term earnings stability.

In summary, Toyo Tanso represents a company with a niche yet mission-critical role in multiple transformation industries. While valuation multiples currently reflect near-term caution, the company’s long-term fundamentals—strong profitability, financial prudence, and strategic end-market exposure—suggest that its earnings power and positioning remain solid as the next investment cycle unfolds.

At Wasabi Info, we publish concise equity reports and market insights through our blog, and also provide custom, tailor-made research to support strategic decision-making for both private investors and corporations.

Our research services include:

• Equities: In-depth analysis of Japan-listed companies not featured in the blog

• Competitor Analysis: Detailed mapping of industry rivals and market dynamics

• Market Entry Intelligence: Insights into local barriers, regulations, and competitor positioning

• Real Estate & Assets: Localized assessments for factory, hotel, or retail expansion

• Field Intelligence: On-the-ground surveys and discreet market checks unavailable through public sources

Reports are available in English, Chinese, and Japanese.

For inquiries, please contact: admin@wasabi-info.com

© Wasabi Info | Privacy Policy

Disclaimer

This report is provided for informational purposes only and does not constitute investment, legal, or tax advice.

The analysis may include forward-looking statements and interpretations based on publicly available information as of the date of writing.

Readers are solely responsible for their own investment decisions and should seek advice from a licensed financial advisor or other qualified professional.

Wasabi-Info.com makes no representation or warranty, express or implied, regarding the accuracy, completeness, or reliability of the information contained herein, and shall not be held liable for any loss or damage arising from the use of this report.